What is MBI?

Missing Beneficiary Indemnity Insurance (MBI) offers Personal Representatives (PR’s) protection from unexpected claims against them for a share of an estate following distribution. Claims could be made by untraced known beneficiaries, or beneficiaries previously not known to the family; therefore, an MBI policy is the only accurate way of obtaining total peace of mind for PR’s.

Insurers can also offer cover against the discovery of a missing will. Remember, not every will is registered on a national database, so its existence may well remain unknown for many years. However, the focus of this article shall be on MBI.

People insure their house, car, and even their pets, yet they do not seem to consider MBI as equally important, which may be due to a lack of understanding of the product itself. In fact, the cover provided by an MBI policy could well turn out to be just as important and valuable as any of the more mainstream, well-known insurance products, in some cases, even more so.

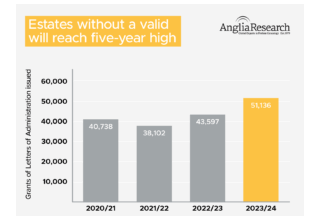

MBI should be considered as particularly relevant in intestacy cases (when someone passes away without leaving a valid will). It is strongly recommended that a policy is taken out given the lack of certainty and mystery around these cases, which are historically more susceptible to claims.

Insurance is often described as a safety blanket, and this definitely applies to MBI policies. It is also worth pointing out that the duration of cover is in perpetuity – this isn’t just an annual policy, this offers cover for life. To use terminology from the pet insurance world, this is a lifetime policy and therefore should give absolute peace of mind for Personal Representatives.

Claims

So, how do claims arise? There are two scenarios where a claim can arise:

- A known beneficiary that couldn’t be found appears

- An unknown beneficiary surfaces

These are two very real risks that can crop up in any case, even those that appear straightforward or where research has been undertaken diligently and in good faith. As in life, though, sometimes things don’t always go to plan, and the appearance of a beneficiary—known or unknown—after distribution can really put the PR in a very difficult financial position.

For the benefit of the doubt, beneficiaries whose whereabouts are known but who aren’t responding to attempts at contact are not an insurable risk. We can help in these circumstances, too, whether verifying an existing address or undertaking overseas tracing; do just get in contact.

The assumptions that the insurance policy won’t offer cover when needed or that the estate value is too low to justify the cost are not reasons enough to ignore taking out cover. Often, PRs decide to risk it by not having cover in place, and for many, this will not develop into an issue.

However, for the unfortunate few, a claim against them can be a massive inconvenience and a potentially unwanted financial burden. Nobody can categorically guarantee that every entitled relative has been found in any case, and these situations do arise.

Even where it appears that every relative has been identified, there is always the possibility of there being more to the story, such as an illegitimate birth. Regrettably, stories of rightful relatives making claims some years after distribution are not reserved solely for the press and movie makers; it happens in real life too.

Policy Buying Process

Insurance has always been about offering peace of mind, and an MBI policy is no different. The PR essentially outsources the chances of a claim arising to the insurer in exchange for a fee (the premium). The insurer then takes on the PR’s risk.

MBI is a niche part of the insurance world, and there aren’t many providers in the market. The few that there are employ specialist class underwriters who understand the market’s fundamentals and are experienced at assessing the niche risks presented. Specialist insurers will most likely underwrite the policies; this tends not to be a market for household names.

Perhaps, unlike other areas of the insurance industry, there isn’t a long list of questions before a quote can be obtained. By marrying the experience of the specialist underwriter with the expertise provided within the original report of the probate genealogist (a copy of which is always required by the insurance provider before quoting), the majority of the necessary information will already be known. Therefore, in most cases, quotes can be produced on demand.

Some insurance providers will only offer quotes presented to them via their strategic probate genealogy partner, such is the level of understanding and trust between them. Anglia Research, authorised and regulated by the Financial Conduct Authority for indemnity insurance business, has just such an arrangement with its long-standing insurance partner, with capacity provided by an ‘A’ rated insurer.

One last point here – if the PR is using a legal professional to administer the estate, it will actually be the legal professional’s responsibility to arrange the policy on the PR’s behalf. But neither they nor the PR should be put off by any pre-conceptions on whether obtaining MBI is difficult or stressful – it very often isn’t. In reality, it is a very sensible and practical way to mitigate risk.

Expense and Type

Cost is of course a consideration. Premiums typically are in the region of 0.5% to 1% of the net total estate value for distribution which, by and large, should be considered as competitive, though there are a few other rating factors. Quotes given are individually tailored as every case is looked at on its own merits – there are no fixed or set premiums.

As with all non-compulsory insurance products, the choice is entirely up to the individual. The decision shouldn’t come down solely to cost if all at possible though. Getting a quote will at least establish likely expense, helping the PR with their budgeting and decision-making.

Premiums will be reflective of the level of cover sought and will broadly be offered on the following options:

- Known missing beneficiaries (also known as Specific Risk)

- No known missing beneficiaries (also known as Comfort cover)

- A combination of known missing beneficiaries and potential unknown beneficiaries

- A combination of the above option plus missing will protection

Whilst it is a fact that MBI cover is another estate expense, further reducing the overall estate value. However, it could turn out to be invaluable for the PR if things do not go to plan and should be considered as a reasonable estate expense.

Ultimately it is the PR who will be left with the responsibility of rectifying an issue after an estate has been distributed, so it is very much the PR’s decision on whether to proceed with purchasing insurance cover to give them personal protection.

Conclusion

It’s hard not to conclude that all Personal Representatives should consider MBI. However, each case is unique, so a decision on whether to purchase a policy should be carefully weighed up.

The size of estate shouldn’t be a consideration in most cases – just because an estate is of a lower value doesn’t make the insurance any less important. After all, a missing beneficiary can appear any time, any place, on any case, regardless of estate value.

The key take away is: If in any doubt, get a quote.

Ultimately it is the PR who will be left with the responsibility of rectifying an issue after an estate has been distributed incorrectly, so it is very much the PR’s decision on whether to proceed with insurance cover. Realistically though, and for the sake of a reasonable one-off cost, it is the only way to genuinely mitigate the PR’s risk.

If you’d like further information on MBI or Missing Will Insurance then please visit our dedicated insurance web page, or contact us on legal@angliaresearch.co.uk