After the loss of a loved one, the responsibilities of being appointed an executor —gathering assets, managing debts, and applying for probate – can feel overwhelming. As a result, many may consider the convenience of pre-paid probate plans, which are becoming increasingly available in the UK. However, while these plans may seem like a good idea for providing peace of mind, they come with significant risks that require careful consideration.

What is pre-paid probate?

Some companies are offering their clients a service whereby they can pay a set amount (usually based on a percentage of the value of that individual’s estate at the time the plan is taken out). The fee covers the fees and takes care of the work involved with carrying out the probate process after they have passed away. At first glance, this may seem like a practical way to alleviate the future burden on loved ones. However, these plans often come with hidden dangers that could cause more harm than good.

Who can sell pre-paid probate?

Alarmingly, there are no stringent qualifications required for selling pre-paid probate plans. Quite often, the plans are sold without delving deeply enough into the assets and estate of the individual taking out the plan in order to understand the likelihood of complications later down the line.

What are the biggest risks associated with pre-paid probate plans?

One of the biggest risks is the lack of transparency of how the funds paid up front are going to be held. Some firms are guaranteeing that funds will be ringfenced or held in a client specific account or trust until they are needed, but what proof is there of this?

The collapse of Safe Hands, a company that sold pre-paid funeral plans, serves as a cautionary tale. Many customers lost their money without receiving refunds when the company went into administration. This highlights the potential vulnerability of funds invested in pre-paid probate plans.

Another major concern is the uncertainty of what the estate will look like when probate is required. Estates can change significantly over time. What may start as a modest estate could grow or become complicated due to unforeseen circumstances. A company offering a fixed-fee probate service decades in advance may not be equipped to handle these changes, leading to potential shortfalls or delays.

Who is most vulnerable to the risks associated with pre-paid probate plans?

All of the above is made all the more worrying by the fact that the target for a lot of these plans are vulnerable and elderly people. It’s sad and worrying to know that it’s all too common for high pressure sales tactics to be used to sell various products and services and pre-paid probate is no different. Marketed in the right way, pre-paid probate can seem like the perfect solution for somebody wanting to ease the burden on their family after they pass away with the risks downplayed or not disclosed at all.

What has been the response from industry professionals and organisations regarding pre-paid probate plans?

We have heard calls from many industry professionals as well as articles in the mainstream press for regulations to be put in place for the selling of pre-paid probate. Big names in the industry such as STEP and The Legal Services Board have all shared their thoughts condemning pre-paid probate.

Most recently, in June 2023, the Competitions & Marketing Authority (CMA) launched an investigation into Will writing and other legal services and part of that investigation was into pre-paid probate, which they have ruled as an area of concern.

Has there been any regulation introduced for similar services?

With all of the potential pitfalls and potential for things to go badly wrong, it’s hard to believe that this service is not yet regulated. This also means that if something does go wrong for anybody who has taken out a plan, there is no security or fall-back option for them.

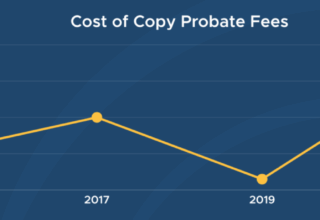

The Financial Conduct Authority (FCA) now regulates pre-paid funeral plans in order to increase standards and increase consumer protection. As of July 2022, the FCA authorises reliable companies in the selling of this service, meaning that any companies who do not comply with their regulations are not authorised to sell them. Some of the regulations introduced include looking after client’s money, bans on cold calling and introduction of a register of approved firms. Many of the reasons for this being input ring-true with the risks posed by taking out a pre-paid probate plan.

Customers of failed pre-paid funeral plans now have a safety-net, but that luxury is not yet being afforded to pre-paid probate customers. However, at the BEST Foundation, we are committed to representing reliable and qualified professionals who are covered by the BEST Foundation Client Guarantee and to giving consumers a space to find them and chose someone that is right for them by searching for a member on our website.